Credit Card Fraud

- On 14/10/2020

Opportunity Costs of Card Fraud and Corruption

While credit card fraud rates have recently trended down, the issue continues to be a threat to businesses and the economy, and it is crucial that merchants continue to implement effective fraud controls.

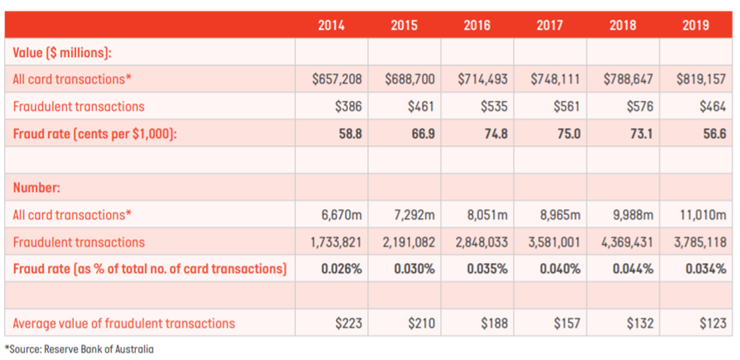

A recent report by AusPayNet highlighted that, in 2019, over $819b dollars was transacted via credit cards, representing an increase of 3.9% on prior years. Fraud accounted for 0.057% of that, at a value of $464M.

Illustration 1: Historical Fraud Rates

Illustration 1: Historical Fraud Rates

It is crucial for Australian businesses to undertake ongoing analysis and monitoring, and to implement other preventative fraud measures. AusPay Net has designed two initiatives to address related threats:

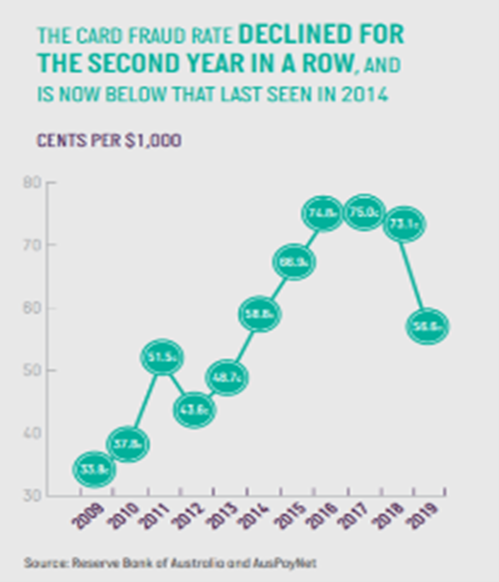

Illustration 2: Fraud Trends (2009-2019)

TrustID Framework version 1.0

Trust between a customer and a business is a key underpinning factor that strongly supports the economy, and a corruption of this relationship can seriously undermine commerce. The TrustID Framework is designed to address this. The Framework comprises a series of rules and regulations that an organisation should adhere to while designing their products and services.

The benefits of the Framework are most evident when merchants are intimately aware of their threat and risk profile, and the extent of exposure to threat actors. However, developing this picture can be challenging, and the use of expert advice and purpose-designed fraud-risk management tools tend to generate better outcomes.

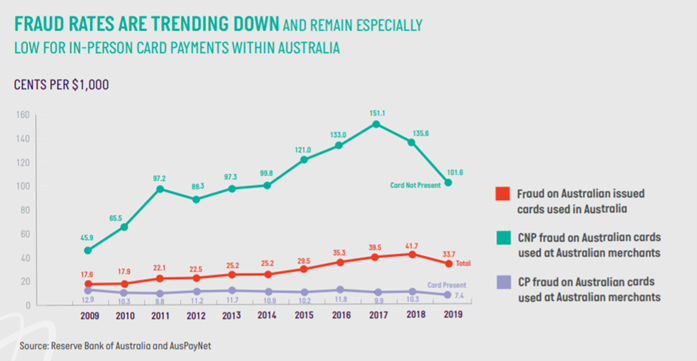

Illustration 3: Historical Fraud Rates

Uptake of these frameworks and associated strategies has clearly had a positive net effect on recent instances of credit card fraud, and by extension, the Australian economy. Moreover, such successes have the effect of creating new market opportunities for merchants.

However, and even though the credit fraud rates have reduced over the last year, precautionary strategies are still needed to reduce risk exposure to within tolerable levels, a metric which varies business to business.

The biggest challenges arises when merchants fail to recognise their potential exposure to threats, and to an extent, defining tolerance levels. According to PWC’s 2018 Global Economic Crime and Fraud Survey, only “…49% of global organizations…” indicated that they had been a victim of fraud and economic crime. But we know this number should be much higher; what about the other 51 percent? According to PWC, 51 % of the organisations are unable to effectively recognise their true potential exposure, a product of a lack of security and risk assessed countermeasures.

In an environment of high surveillance and government enforcement, companies must realise that the dynamics of risk exposure is beyond the limits of basic business costs.

There is no doubt that awareness of fraudulent activities is increasing. Despite this, businesses across the spectrum need to consciously acknowledge the very high degree of exposure that they, and their financial wellbeing, are faced with.

Credit card risk is one of the most common threats a business is exposed to. If not assessed, mitigated and monitored, other risk exposures can emerge. In aggregation the accumulated financial and reputational losses can be huge.

Adopting proactive measures, which are underpinned by security/fraud risk assessments, is essential. The results will ultimately help businesses achieve their goals.

Areeba Khan

Areeba is a 2nd year student at the University of New South Wales, studying a Bachelor of Actuarial Studies. She was selected for an internship based on her excellent appreciation of quantitative risk methods.

How to get started with SECTARA

If you’re looking for an effective platform to assess security/fraud risks, take a look at our online system, SECTARA. There are several methods to get started:

- Sign up to our absolutely Free Plan.

- Register online for one of our Bronze, Silver or Gold Plans.

- Arrange an online demo.

- Contact us for Platinum Plan pricing.